As an early Google and YouTube businessperson, I had the great fortune to help build the online video ecosystem from the very beginning. Most people don’t believe me when I tell them that in 2006, a small Google team including George Strompolos, Adam Relis, and I used to call up video owners and ask them to mail their videos to Google in the U.S. mail. That’s right—we were mailed videos, and we uploaded them ourselves.

Right now, Virtual Reality feels very much like mailing videos did back in 2006. VR is messy. Watching and delivering content takes effort. We have unsightly tangled wires. A premium experience looks like it will require a $1500 or more investment between the headset and a computer to power it. If someone wants to create and distribute VR content, it requires advanced skill. There are no real business models or best practices.

Yet this is the pivotal moment. This is where platforms, careers, and groundbreaking companies are made. The future is equal opportunity right—wait for it—now!

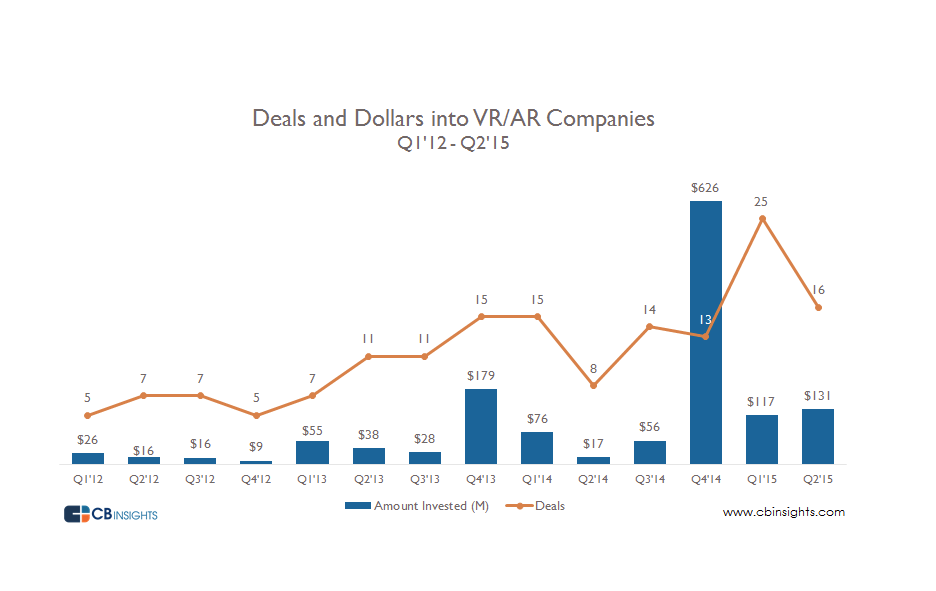

It’s fascinating to see some of the same online video investment patterns emerge in VR ecosystem investment a decade later. Early venture capital in both industries have been deployed in extremely similar ways. Take a look at how investment has flowed into virtual reality courtesy of CB Insights:

If you look through the same CB Insights reports for the online video space back in 2006, you’ll see exactly the same chart. A climbing wave of excitement. The amounts invested quarter over quarter are becoming real and substantial. Make no mistake, it’s time for VR to have its big moment.

How the dollars are being deployed in both ecosystems is very similar as well. Naturally, huge amounts of capital have been invested in search of finding virtual reality’s YouTube. When we look at the competitive landscape back in 2006, there were no less than thirteen companies all vying to be the go-to distribution platform for video. Like how most ecosystems pan out, we saw a very binary outcome occur with YouTube. Platforms either became YouTube, or they became the companies we don’t remember, like Metacafe.

It’s not just platforms though. Online video saw a rash of investments in new content companies that promised to create the best-in-class content specifically for online video. Back then it was companies like maniaTV, and NextNewNetworks. Now it’s companies like Jaunt, who have raised huge amounts of capital.

Flash forward a few years, and YouTube had become the giant we all know today. And then, in perhaps a sign of things to come for VR, the YouTube ecosystem experienced a cold winter. All of the capital invested from 2005-2008 had been deployed, and the ecosystem struggled to expand business models, find new funding, and generate actual revenue.

It was not until the industry embraced the unique characteristics of the medium that we began to see it expand and start to sustain itself. Online video finally stopped trying to look like television. The ecosystem finally embraced and became proud of the UGC content creators (‘influencers’) that made the platform a smash success. Since that critical coming of age moment, we have seen online video companies like Maker Studios and Fullscreen sell for hundreds of millions of dollars. We have successful public market companies like Tubemogul. Online video is growing up.

A decade has now passed since online video started. I’m now an investor in Los Angeles, investing in virtual reality in the same way online video investors did a decade ago. It’s helpful for me to know we can look to the last wave of video excitement to help interpret the virtual reality patterns and signals we’re seeing today. I’m thrilled to be announcing a series of virtual reality investments in the coming months. You can be sure that we’ll be looking at a decade of online video history in helping us make key business decisions today.